- The Tampa Real Estate Report

- Posts

- Why Waiting for a Recession Could Cost You

Why Waiting for a Recession Could Cost You

The Market Isn’t Crashing. Here’s Why That Matters.

In a recent survey, nearly 30% of homebuyers said they’d be more likely to purchase a home during a recession. This is based on the assumption that a recession will bring lower home prices and interest rates, signaling a better opportunity to buy.

But history tells a different story, and understanding it could save you from making a costly mistake.

INTEREST RATES OFTEN FALL, BUT PRICES DON’T

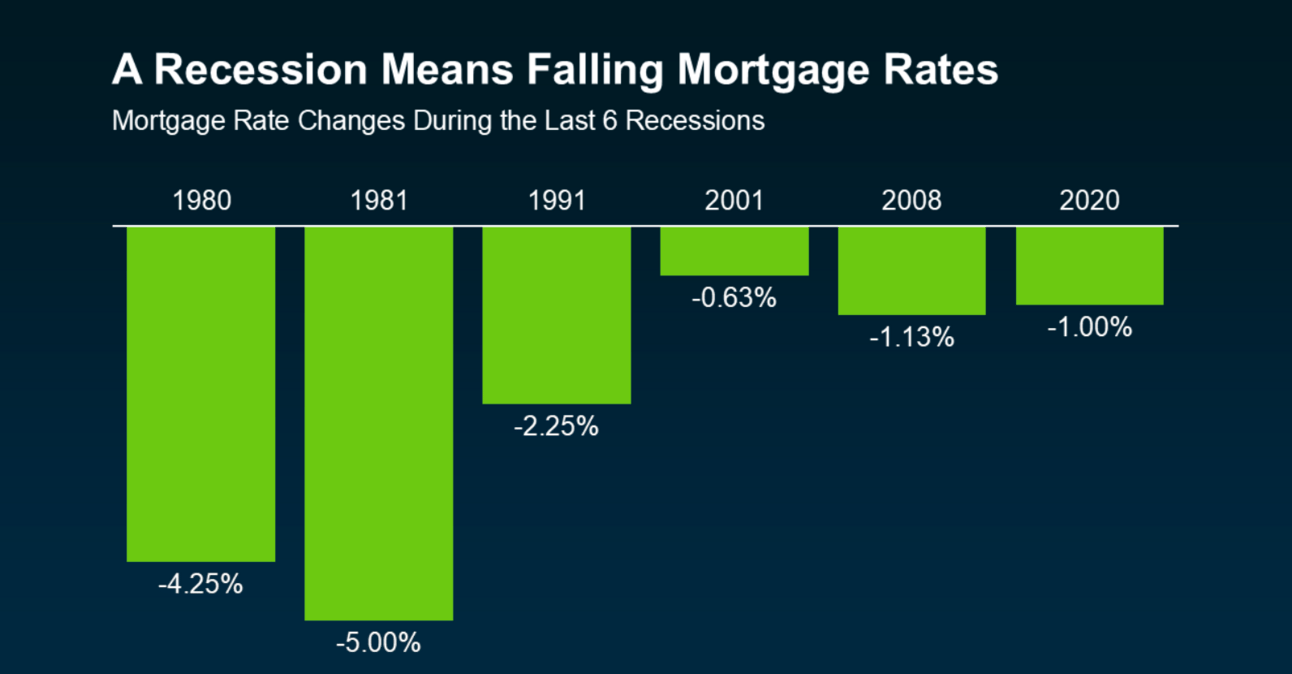

It’s true, recessions typically do bring lower interest rates. But, home prices are a different story. Here’s what that looks like:

Interest rates usually decrease during recessions to stimulate economic activity

In fact, interest rates declined in each of the last 6 recessions

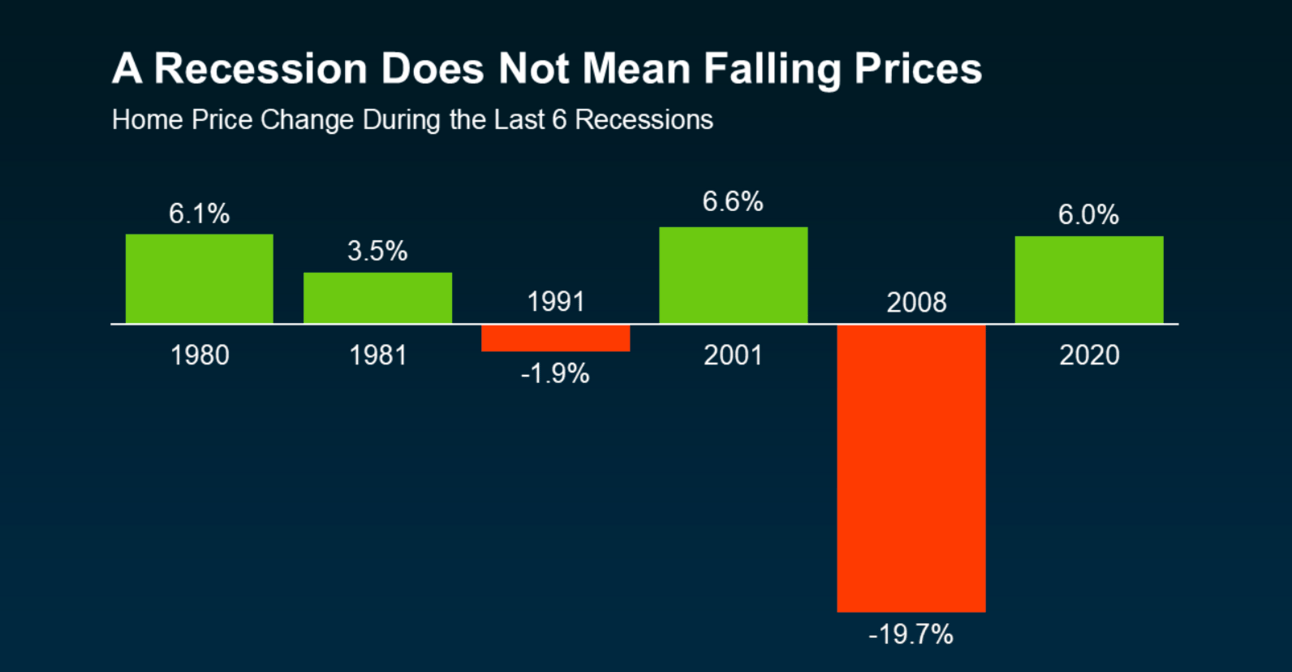

Many people also assume that home prices will drop. But, that is usually not the case.

Home prices actually increased in 4 of the last 6 recessions

BOTTOM LINE

So, while many people think that if a recession hits, home prices will “crash” like they did in 2008, that was an exception, not the rule. In fact, home prices tend to stay on whatever path they were on pre-recession.

According to the June 2025 data, Tampa home prices are down 3.2% year over year. While inventory is elevated, demand remains resilient. That means:

A dramatic price drop is unlikely anytime soon

Waiting for “the crash” could mean missing today’s opportunities

Bottom Line: While a future recession may bring lower mortgage rates, it likely won’t deliver significantly lower home prices.

MAKE A SMART MOVE

If you’re considering buying or selling, don’t wait on headlines or hypotheticals. Reach out, and I’ll walk you through proven strategies I’m using with my clients to succeed in today’s market, no matter what the economy does next.

Best,

This is for informational purposes only. All listing and market data are deemed reliable but not guaranteed. If you’d like to unsubscribe, click the unsubscribe button below.